You can be an entrepreneur and can work from home. Owning your own business is a viable option that can bring you self-fulfillment and freedom while still providing a steady income to support a good life.

But launching your own business can’t be everyone’s cup of tea. You need to be prepared for the challenges that come with it. Different entrepreneurs possess different skill sets. You do not need to know how to do everything to be a successful business person. Figure out which entrepreneur skills you possess and which you need to acquire. It doesn’t mean that every entrepreneur needs the same skill set.

Some entrepreneurs are stronger in the creative, technical, accounting, or engineering areas than they are in business fundamentals.

As an example, entrepreneurs with good management skills may not also know how to code. Some entrepreneurs may be stronger on the technical side, some may be in engineering areas, and some may be in accounting. Likewise, there are lots of areas in that entrepreneurs hold a strong side.

In this article, we are going to discuss some of the essential accounting skills that an entrepreneur must have. Before diving into it, let us discuss why an entrepreneur needs accounting knowledge?

Why does an entrepreneur need accounting knowledge?

Accounting is the language of business that shows us how we’re doing, what we’re doing, how much money we have coming in, how much money we’re spending etc.

With the right accounting knowledge, an entrepreneur can make informed business decisions that may impact the start-up’s future. An entrepreneur doesn’t require any formal training in accounting. But with knowledge of certain fundamentals, such as cost accounting and the accrual system of accounting, they can determine a product’s profitability and make better decisions on whether to release it or shelve it for later.

Here we have listed some of the significant accounting skills that every entrepreneur must know.

Must-Know Accounting Skills for Entrepreneurs

Entrepreneurs must know how to manage cash flow

If you are an entrepreneur, managing cash flow is one of the significant skills you must learn to be successful in your business. The heart of any business is the management of cash.

For most businesses, particularly for new entrepreneurs, where credit lines are narrow and financing is hard, money proves to be one of the most crucial assets. A sudden turn of events or unexpected expenditures can arise quickly and this may lead to affect your business.

Some of the basics of cash flow management include,

- What is the difference between a profit and a loss?

- Why do I need to manage cash flow?

- How will I manage cash flow issues at my company?

- What are the key issues with cash flow management?

- How can I avoid having my company ‘run out of money?

- How should I budget my funds, specifical tax on profits and rebates?

- What are the key differences between revenue and income?

- How do revenue, and taxes affect my cash flow?

- What is a balance sheet, and how does it contribute to managing my company’s cash flow?

Entrepreneurs must know how to manage a Balance Sheet

With a balance sheet, the entrepreneur can easily and quickly make decisions to know how the company is doing financially as well as where to invest in assets and equipment. It makes significant to keep track of the assets and liabilities of the company.

The assets are helpful in growing a business. They enable a venture to generate income, while the liabilities should be kept at a manageable level. The liability prevents the venture from receiving more income due to high-interest rates from its lenders or counter-party risk.

Entrepreneurs must know about accounting credits and debits

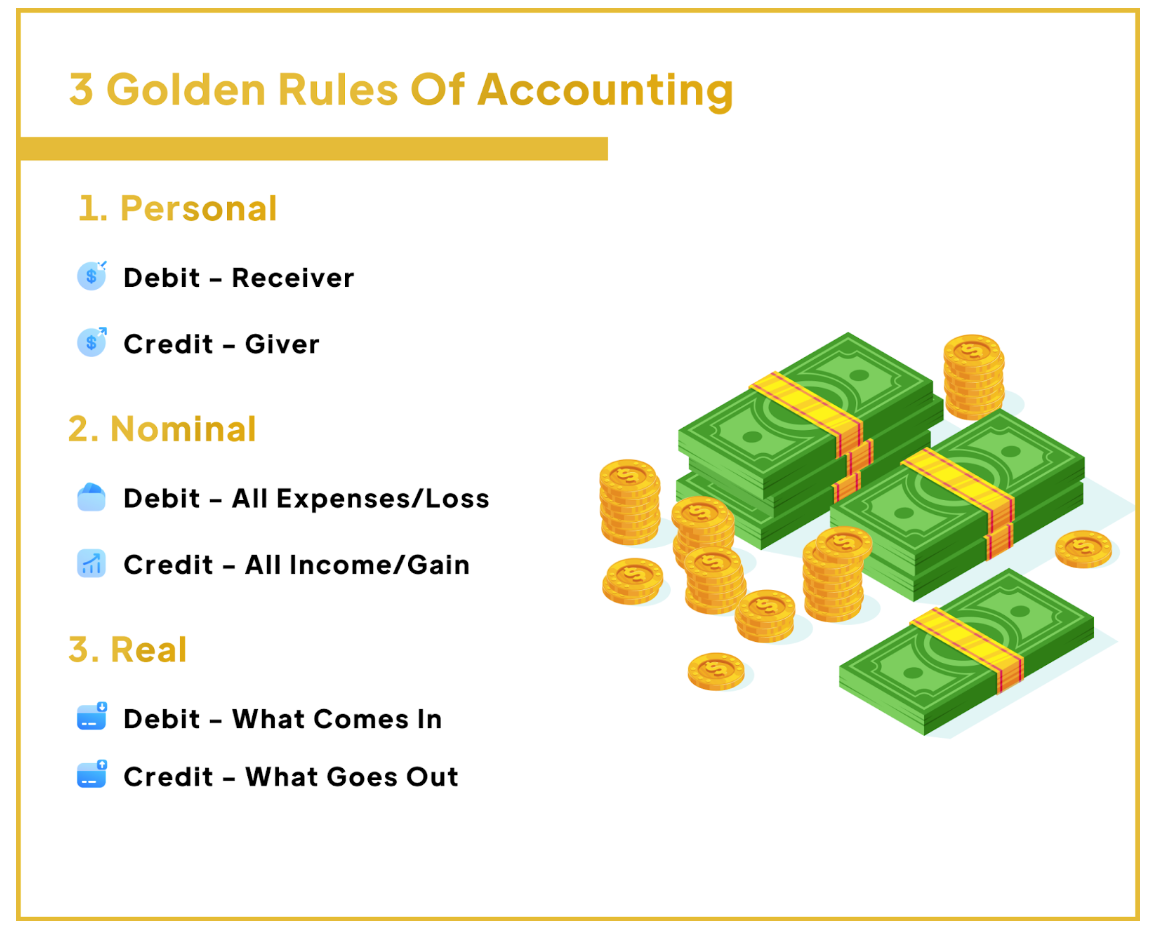

Entrepreneurs often get confused about what are the accounts that would increase or decrease when one business transaction happens. Here are the 3 Golden rules of accounting.

Entrepreneurs must estimate the profitability path

Entrepreneurs must estimate the profitability path and the potentiality to create a sustainable business. In accounting, profitability (or Profit), is a measure of a company’s performance.

Profitability is defined as the difference between net income and assets. Assets are money or property that a business owns. Net income is what’s left over after paying expenses during a certain time period.

A company’s decision-making, including its pricing policy, will generally be guided by its profitability.

Entrepreneurs must know to forecast the business’s future

Growth is the name of the game for entrepreneurs. Not only for entrepreneurs but also for most businesses. Some of the entrepreneurs are happy as a single businessman, some want to ass employees, and even some want to scale dramatically. But their focus is to increase their revenue streams.

To grow successfully, entrepreneurs must be capable of predicting their business future such as — future operating costs, future revenues, future profit levels, and similar elements. As entrepreneurs, using small business budgeting software for prediction is one of the simple ways. Using forecasting and budgeting software you can manage and forecast – cash flow, what-if scenarios*, estimate profitability, and more.

* What-if scenario is hypothetical. For example

- What happens to your business when there is a sudden lockdown due to corona?

- What happens to your revenue when there is a new competitor in your area

It will take you to prepare for your future business revenue.

Get 4 Free Sample Chapters of the Key To Study Book

Get access to advanced training, and a selection of free apps to train your reading speed and visual memory